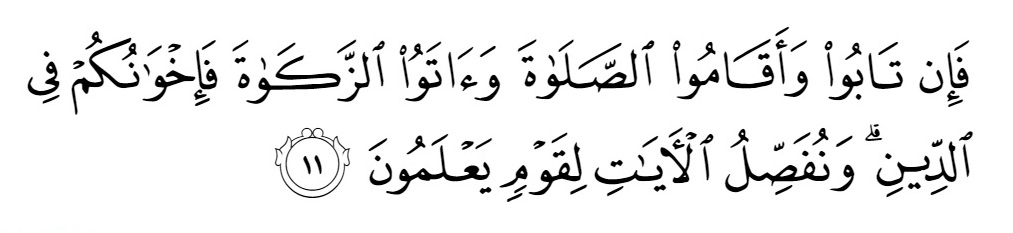

Zakat is the Third Pillar of Islam and Zakat (Poor-due) has been mentioned together with Salah (Prayer) at 82 places in Quran; a typical instance may be seen in the the following verse below:

Then, if they repent and establish Salāh and pay Zakāh, they are your brothers in faith. We elaborate the verses for a people who understand. [9: 11]

Contents

Importance of Zakat in Islam

Wherever in the Quran the qualities of believers are described, their eagerness for establishing Prayer and Poor-due is mentioned together.

The Prophet of Allah has mentioned Zakat as a fundamental tenet of Islam.

When once asked what Islam was, Prophet Muhammad replied:

“Worship Allah and do not ascribe any partner to Him, establish obligatory Salah (Regular Prayers), pay Zakah (Poor-due), and observe Sawm (Fasting) in Ramadan”. (Bukhari and Muslim)

Dhammam Bin Thalaba who was a companion of Prophet Muhammad narrates that once he inquired from Prophet Muhammad:

“I ask you in the name of Allah whether He has commanded you to collect Zakat (Poor-due) from the rich among us and distribute it among the poor?”

The Prophet (blessings and peace be upon him) replied, ‘certainly’.”

The Hadiths of the Prophet Muhammad in support of the obligatoriness of Zakat are very large in number and have been read and believed ever since the lifetime of the Prophet.

Muslim scholars are of consensus that Zakat is obligatory on Muslims like Salah and Muslims have been sincerely observing the practice of paying Zakat throughout the history of Islam.

Allah has mentioned the performance of Salah and giving of Zakat as signs of a believer’s correct faith, obedience to his Lord, peace with Him, and feeling of brotherhood for Muslims in general.

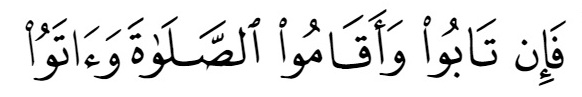

It is stated in the Quran:

Then, if they repent and establish Salah and pay Zakah, leave their way. Surely, Allah is most Forgiving, Very-Merciful. [9: 5]

Fundamental Principle of Economic System of Islam

Basic principle of Islam’s economic system is that everything belongs to Allah. The Quran teaches man to submit all his affairs to Allah and emphasizes only one responsibility of man; that he is the vicegerent of Allah on earth.

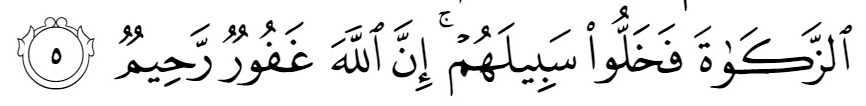

Quran addresses Muslims in these words:

And give them out of the wealth of Allah that He has given to you [24:33]

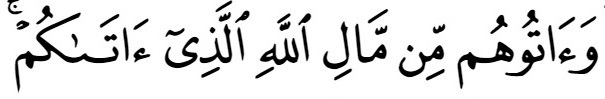

Quran elaborates the same theme in the following way:

Believe in Allah and His Messenger, and spend out of that (wealth) in which He has appointed you as deputies. [57 : 7]

It is clearly stated in the above verses that the true owner of all things is Allah.

Man therefore does not have any right to take pride in having given out as Zakat a very small portion of his wealth with which Allah has entrusted him.

And what is wrong with you that you should not spend in the way of Allah, while to Allah belongs the inheritance of the heavens and the earth? [57 : 10]

Man therefore should realize and accept that he is in fact not the master of his belongings, land and property, but merely a trustee answerable to the Supreme Master, Allah the Almighty.

Allah Gives Ownership Rights to People

Allah, the Wise and the Merciful, does not deprive man of the satisfaction of being the owner of his property which sometimes appears to him as fruit of his efforts.

Although denying the right of ownership to man should have been perfectly justified but it would have adversely affected man’s self-confidence, enthusiasm, ability to grow, spirit of competitiveness, interest in exploratory enterprises, and the gratification that he naturally enjoys by considering his earnings as fruit of his labour.

It is the same kind of happiness that man experiences in associating himself to his family home and in inheriting his ancestral property.

If he were denied this happiness, he would have never felt love and gratitude for his predecessors and desire to protect and multiply the property for himself and his successors.

Human life then would have lost all marks of enthusiasm, competitiveness, and ambition which are necessary for the existence and advancement of man.

The world then would have been reduced to a large workshop allowing human beings to move like parts of a machine; deaf, dumb, without heart and conscience, incapable of enjoying contentment or appreciating happiness.

That is why Allah has repeatedly referred to wealth as possession of man, not of the Creator or Provider:

Do not eat up each other’s property by false means, nor approach with it the authorities to eat up a portion of the property of the people sinfully, while you know (that you are unjust in doing so). [2 : 188]

O you who believe, spend of the good things you have earned, and of what We have brought forth for you from the earth [2 : 267]

Do not give the feeble-minded your property that Allah has made a means of support for you, and do feed them from it, and clothe them, and speak to them in fair words. [4: 5]

Thus, a large number of verses in the Quran do not only refer to wealth as man’s possession, but at places mention spending of it for the pleasure of Allah on noble causes as virtuous loan to Allah.

Wisdom Behind Fixing Percentage of Zakat by Allah

As the Islamic society expanded with time, people fell into different economic classes: the rich, the poor, and the average. Also, there lived in that society the highly generous, the extremely miser, and the ones following the middle course.

They also differed in the level of faith: persons of strong faith could easily make a great financial sacrifice for the needy while those weak in faith found giving even a little money to others by way of help very trying for themselves.

Thus it was Allah’s great prudence that He Himself fixed for the rich a percentage of their savings as Zakat which remains suitable for all people at all times.

The percentage of Zakat fixed in Islam is neither so large as to strain the middle- class people, nor so little as to appear petty and insignificant to the rich.

Allah did not leave the percentage of Zakat to be fixed by individuals on the basis of their individual ambition, for ambitions vary from person to person and from time to time.

Even Muslim scholars or Muslim rulers were not entrusted with this task, for they were not above human weaknesses either.

Thus, it was indeed the wisdom of Allah that He made Zakat obligatory and Himself fixed its percentage to save Muslims from confusion.

Items on which Zakat is to Be Paid

Prophet Muhammad prescribed the percentage of Zakat, mentioned the things for which Zakat had to be paid and laid down the conditions in which it became obligatory.

He divided such things into four categories:

- Produce of cultivation and garden,

- Cattle (camels, cows, goats, etc.),

- Gold and silver, which are the bases of the whole financial system, and

- Commercial articles of all kinds.

When Zakat is to be Paid

Zakat is obligatory on a Muslim once a year.

But for gardening and cultivation, a year’s period will be considered as complete only when the fruit in the garden and harvest in the field are ripe and ready.

In fact, the period of one year for the payment of Zakat was most appropriate and suitable to all.

If Zakat was to be paid monthly or weekly, the rich would have been put under great strain. If it were paid once in lifetime, the poor and the needy would have been hurt.

Why Zakat is 2.5% / 5% / 10% / 20%

The percentage of Zakat is determined on the basis of the labour and effort involved in managing a particular source of income.

For example, if a person finds a treasure by chance, a year’s time is not needed to pay Zakat on it. He will have to pay one-fifth or 20% of it as Zakat as soon as he takes possession of it.

But if a person makes effort and undertakes labour in manipulating a source of income, he will pay one-tenth or 10% as is the case with the produce of cultivation and gardening. This is when he cultivates a piece of land by ploughing it and sowing seeds in it himself but not doing anything to irrigate it, as the land is itself irrigated by natural water.

But if he is also responsible for irrigating the land, he will pay the twentieth part or 5% of the harvest as Zakat.

If there is a source of income in which the profit depends on the labour of the owner who is also responsible for its management, administration and security, he will be required to pay the fortieth part or 2.5% of the income only. This is so because in such a business a person remains more responsible for administration, time, and security than a cultivator or a gardener.

Similarly, the cultivation done with the help of natural rains is easier than the cultivation done through irrigation.

In the same way, the discovery of a treasure is the easiest of all sources of income mentioned above.

Where Zakat can be Spent?

The uses of Zakat are laid down in the following verse of the Quran:

Zakah expenditures are only for the poor and for the needy and for those employed to collect (zakah) and for bringing hearts together (for Islam) and for freeing captives (or slaves) and for those in debt and for the cause of Allah and for the (stranded) traveler – an obligation (imposed) by Allah . And Allah is Knowing and Wise. [9: 60]

Zakat is a Form of Worship & Not a Penalty

It should be remembered that Zakat is not a tax or a penalty imposed by a state. It is an act of worship like Salah (Prayers) and Sawm (Fasting) and is a means of securing Allah’s approval as well as moral discipline and refinement.

Therefore while paying Zakat a person should never let any feeling of superiority or pride rise in his heart. Instead, he should do it with humbleness and should feel grateful to the poor who accept it.

It is required that one should carefully look for and select the deserving recipients of Zakat himself.

It is also considered better to distribute Zakat among the poor of the same place from where it is collected (unless there are no poor people in that area).

In the Quran, Zakat is projected as a deed opposite in nature to interest: interest is condemned as much as Zakat is praised.

Giving Away Extra Wealth as Charity

Prophet Muhammad (blessings and peace be on him) tried to create this moral attitude in his companions and followers that all extra wealth had to be given away to the needy for the pleasure of Allah.

For this he invoked them so effectively that people sometimes wondered if they really had any right to keep to themselves their extra wealth.

However the fact that remains is that to give away all extra wealth is not a law in Islam, but a virtuous deed done in goodwill that Islam wishes to promote among its adherents.

Prophet Muhammad himself exemplified this quality to the highest degree. Quran says:

You have indeed in the Apostle of God a beautiful pattern (of conduct) for any one whose hope is in God and the Final Day, and who engages much in the praise of God. [33: 21]

The Prophet is reported to have said in an Authentic Hadith:

“Whoever has an extra animal to ride should give it away to him who doesn’t have one.

Whoever has an extra breakfast should give it away to him who doesn’t have one” (Abu Dawud).

The Prophet, blessings and peace be on him, also said:

“He who has food for two persons should also invite the third to eat with them. He who has food for three should also invite the fourth” (Tirmidhi).

The Prophet Muhammad also said:

“He did not bear faith in me who ate to his fill and slept all night knowing that his neighbour was starving” (Tabrani).

It is related in another Hadith that:

A man came to the Prophet of Allah and said, “O Prophet of Allah, give me some clothes to wear”.

The Prophet inquired, “Don’t you have any neighbour who has some extra pair of clothes?”

The man replied, “There are more than one (such persons).”

The Prophet thereupon said, “May Allah not join you and them then in the paradise” (Tabrani).

What is the Value of Man in Islam

Prophet Muhammad elevated the position of human being and value of human sympathy and compassion to a height which was beyond human imagination.

According to the teachings of Islam, if a person fails to sympathize and support an aggrieved person, he is like one who fails in obeying Allah.

The following saying of the Prophet, which is a Divine Tradition (Hadith Qudsi), underscores this theme very effectively.

“Allah will tell one of His bondsmen on the Day of Judgement, ‘I fell ill, but you did not visit Me’.

He will reply, ‘Lord! how could have I visited You, for You are the Cherisher and Sustainer of the worlds?’

Allah will tell him, ‘Didn’t you know that such and such slave of Mine was ill, but you did not visit him. Had you visited him, you would have found Me there.

O son of Adam! I asked you for food but you did not give food to Me’.

He will submit, ‘My Sustainer and Cherisher, how could have I provided You with food, for You Yourself are the Cherisher and Sustainer of the worlds?’

Allah will tell him, ‘Don’t you remember that such and such slave of Mine asked you for food, but you did not give food to him. Had you given food to him, it would have reached Me.

O son of Adam, I asked you for water but you did not give Me water to drink.’

He will submit again, ‘Lord! how could have I given You water to drink, for You are the Cherisher and Sustainer of the worlds?’

Allah will tell him, ‘Such and such bondsman of Mine asked you for water but you did not give him water to drink. Had you given him water to drink, you would have found it with Me’ (Muslim).”

This is, indeed, the highest level of Allah’s appreciation of a person’s help to his fellow beings.

There is yet another Tradition in which the Prophet Muhammad (blessings and peace be on him) has emphasized the value of having compassion and goodwill for one another:

“None of yon could be a perfect believer unless he wishes for his brother (in faith) what he wishes for himself “